Python is currently the preferred programming language for developing websites and solutions across various sectors, including financial technology and finance. The modelling capabilities and simple syntax of Python could be the cause of the demand rise. It results in the preferred result for web and mobile applications that are developed to achieve a variety of goals in the fintech sector, including speedier transfers, selling, and evaluation.

Python is the code of preference for the majority of Fintech companies since it can be used to create a wide range of software. In order to obtain a scalable Fintech solution with cutting-edge security features, they opt to work with a leading Python programming company. Additionally, Python provides a wide range of remarkable tools for projects involving data analytics, scientific computing, and online applications with AI.

Is Python Really Useful for Fintech?

Companies are increasingly using Python development services for Fintech apps. It offers safe information sharing and wonderful data analytic capabilities, which are two of the most crucial qualities needed for development. Python is a simple yet effective coding language that helps create full-fledged financial systems.

Here are some of the top examples of Python-based app development in the FinTech sector:

- Square,

- Paypal,

- Stripe,

- Zopa,

- Robinhood, and many more.

Python is utilized by entrepreneurs to easily construct their FinTech apps and deploy prototypes due to the possibilities it provides.

Python's Use in the Development of Fintech Products

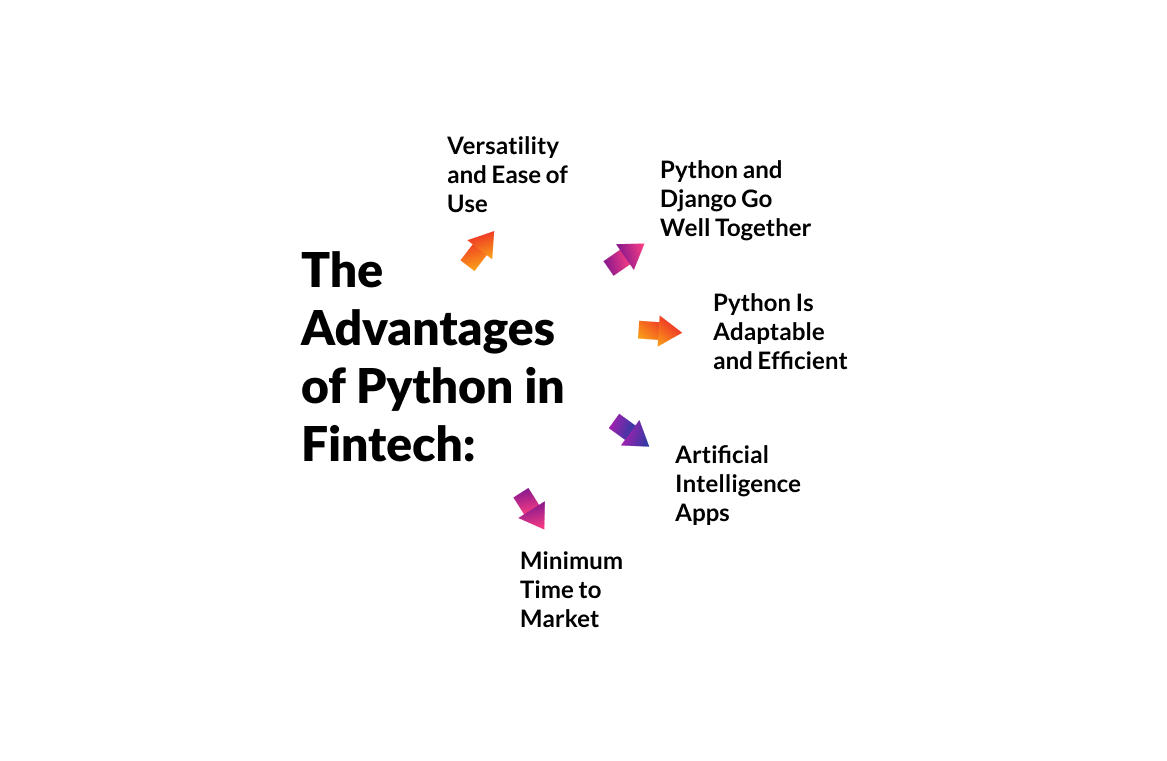

Versatility and Ease of Use

Financial provider applications are extremely complex and also require a lot of work. Python makes it incredibly simple to develop short, requirement-specific scripts. The flexibility of Python programming services enables them to offer streamlined, efficient solutions for producing outstanding results.

Python and Django Go Well Together

Django and Python work well together. A software engineering company's Python development team can produce outstanding digital capabilities thanks to the framework that is offered. Django delivers on that promise since working with data is essential in the fintech industry. It provides a variety of services, including data analysis, and scientific computing.

Python Is Adaptable and Efficient

To sustain flawless service support, the fintech sector must regularly overcome challenges. Python is highly helpful in this situation since it offers quick ways to get past obstacles while maintaining all the security precautions. To experience the breakthroughs and go forward with better commercial outcomes, contact us, and we will help you hire a Python developer.

Artificial Intelligence Apps

The use of Python in machine learning is among the well-known aspects. ML and AI are aimed to prioritize data. Working with FinTech algorithms is exceptionally easy thanks to the outstanding and powerful Python Machine Learning setting. It enables the creation of completely original talks for chatbots and creative applications. Banks and similar establishments can make intuitive decisions thanks to them.

Minimum Time to Market

In order to meet customer needs, the banking industry should be extremely flexible. Rapid prototyping guarantees interoperability and builds market confidence from the ground up. The rapid minimum viable product (MVP) development spares time and also lowers the likelihood of errors and opens up significant potential for the future. Fintech organizations have a benefit over non-Python software in the market by developing MVPs quickly.

Different Fintech Product Types Python Can Build

Finance Software

In applications for banks, Python is frequently used. It acts as a centralized database for all data related to customer profiles, payments, as well as other banking activities. Customers can pay distantly online with the aid of banking software, and financial institutions can simplify most of their daily tasks.

Transactions and Online Wallets

One form of financial technology product that can be created with Python is a digital wallet. Users can keep their bank details, credit card numbers, and other critical data in one location with their help. Shopping online and keeping expenses in check may become much simpler and quicker as a result.

Insurance

Products related to the insurance industry are also expanding. Insurance firms can enhance the client journey at each point of contact with the assistance of AI, bots, and thorough data analysis. Insurtech nowadays considers machine learning and customization.

Crypto

A virtual currency can be created with Python. Cryptocurrencies are a type of electronic or digital tokens. Cryptography is used to make safe transactions and in the creation of such items.

Due to the distributed nature of cryptocurrencies, neither a government nor a commercial bank can control them. One well-known cryptocurrency is Bitcoin. You must first decide whether to make your coin available to the public or confidential in order to generate it with Python.

Data Evaluation

In order to make the appropriate decisions for the occasion, the financial sector requires quantitative data analyses. Python libraries are effective in producing very sophisticated algorithms for predicting and analyzing data. These are valuable for making important decisions fast and improving efficiency in the long term.

Conclusion

The technologies and platforms that make up your primary product will have a significant impact on how long it lasts for fintech startups.

Python's fintech viability is owing to the following facts:

- Python boasts an abundance of open-sourced libraries which offer readily available solutions for a variety of typical fintech issues.

- This framework’s simplicity reduces issues and mistake rates.

- Python is the best pick for quick product deployment.

- Python has a simple syntax that will make it easier for developers, technical specialists, and leads to work together.

Doesn't Python seem like the perfect FinTech computer language for creating financial software? Because of its many benefits, like its user-friendliness and interesting developing tactics, Quintagroup-hired developers enjoy working with it.

Furthermore, Python can brag about having access to a ton of frameworks and modules that improve the creation of any payment system. You end up with the ideal output of excellent value. That is what Python developers—who Quintagroup employs for you—can accomplish. Get in touch with us to embody your dream.